how much federal tax is taken out of my paycheck in illinois

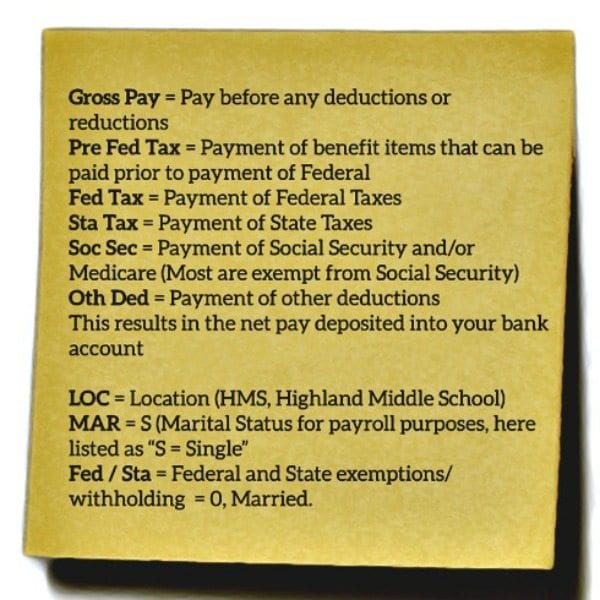

Put Your Check in a Bank. How do I calculate how much tax is taken out of my paycheck.

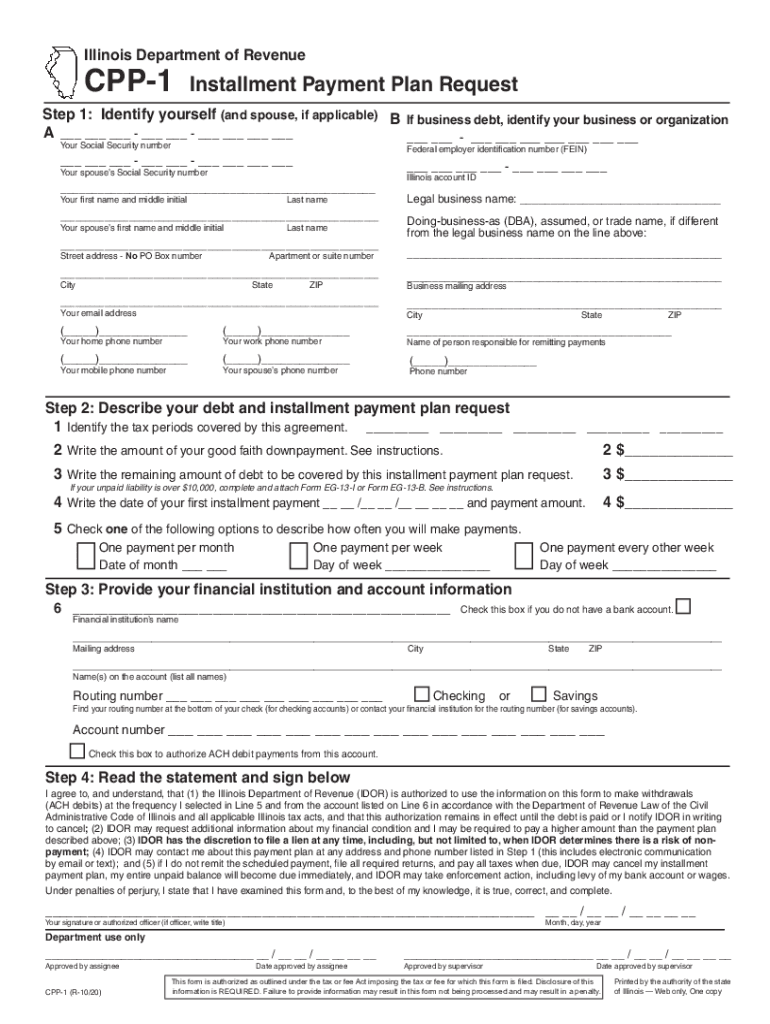

Il Dor Cpp 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

Newly registered businesses must register with IDES within 30 days of starting up.

. The next 30249 you earn--the amount from 9876 to 40125-. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

For the employee above with 1500 in weekly pay the calculation is 1500 x. The wage base is 12960 for 2021 and rates range from 0725 to 7625. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For 2022 the limit for 401 k plans is 20500.

Amount taken out of an average biweekly paycheck. The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and 40000. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

For a single filer the first 9875 you earn is taxed at 10. How much is 60000 a year after taxes in Illinois. For the first 20 pay periods therefore the total FICA tax withholding is equal to or 52670.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. If youre a new employer your rate is 353.

How much is payroll tax in Illinois. Federal income taxes are paid in tiers. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors including your income number of dependents and filing status.

The total bill would be about 6800 about 14 of your taxable income even. If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more. Social Security and Medicare.

For those who make between 10000 and 20000 the average total tax rate is 04 percent. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Illinois Hourly Paycheck Calculator.

Only the Medicare HI tax is applicable to the remaining four pay periods so the withholding is reduced to 6885 x 145 or 9983. Switch to Illinois hourly calculator. For wages and other compensation subtract any exemptions from the wages paid and multiply the result by 495 percent.

Generally the rate for withholding Illinois Income Tax is 495 percent. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. How much tax is taken out of a 500 check.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Employers in Illinois must deduct 145 percent from each employees paycheck. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing status or wages earned at another job. Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Newest Checking Account Bonuses and Promotions. Its important to note that there are limits to the pre-tax contribution amounts.

The average tax rate for taxpayers who earn over 1000000 is 331 percent.

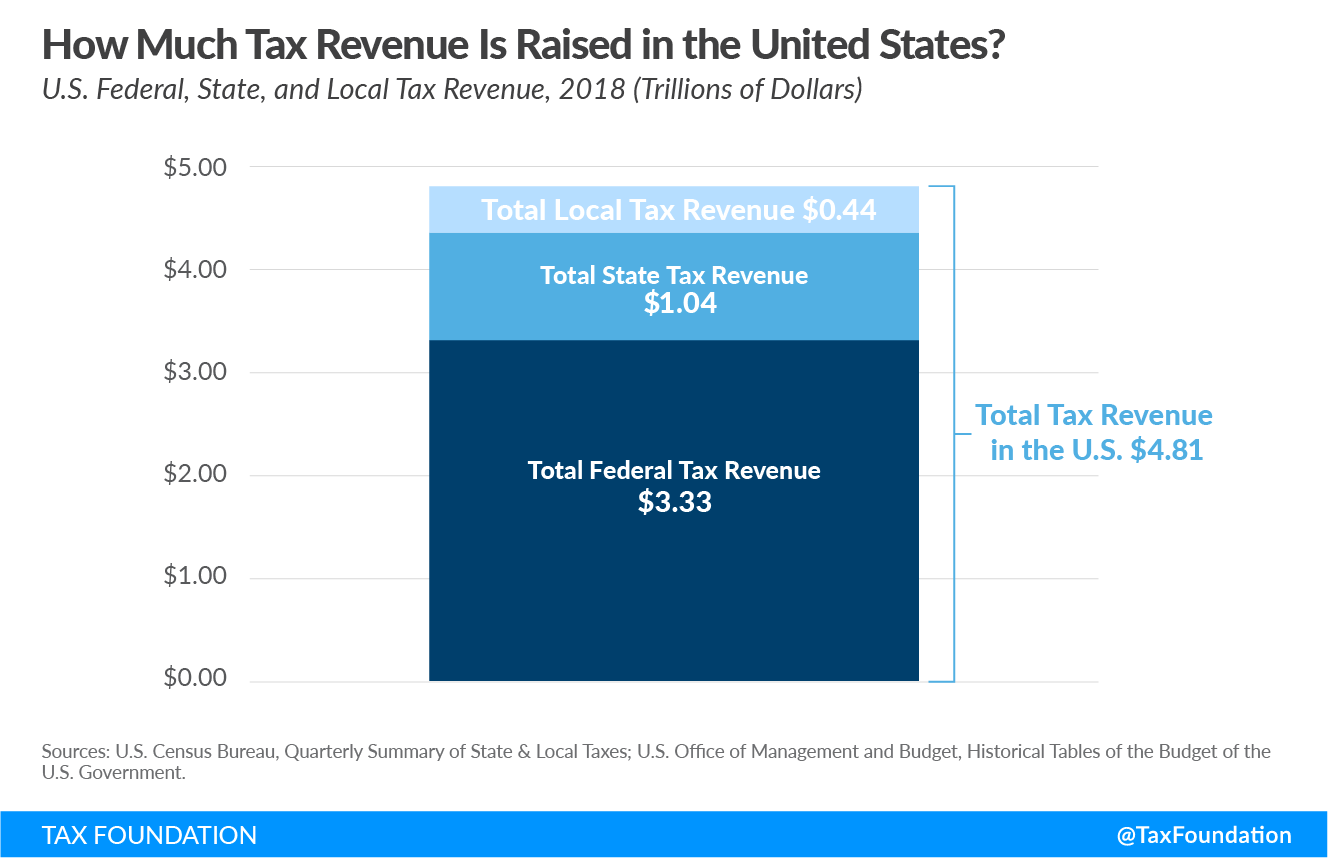

Government Revenue Taxes Are The Price We Pay For Government

Illinois Paycheck Calculator Smartasset

Illinois Income Tax Calculator Smartasset

Missouri Income Tax Rate And Brackets H R Block

How To Fill Out Irs Form W4 2021 Fast Youtube

2022 2023 Tax Brackets Rates For Each Income Level

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

March 2021 The Dancing Accountant

Illinois Income Tax Calculator Smartasset

How Do I Know If I Am Exempt From Federal Withholding

Government Revenue Taxes Are The Price We Pay For Government

Illinois Paycheck Calculator Smartasset

Here S The Average Irs Tax Refund Amount By State

How To Stop Illinois Department Of Revenue Collection Gordon Law